Bill To Ban Lawmakers From Stock Trading Advances In Senate

A Senate committee has narrowly approved a bill that would ban members of Congress from trading individual stocks — a move aimed at restoring public trust in a group that has profited from privileged access to information. But, the bill still faces a major uphill climb before it passes the full Senate and House.

The bill’s sponsor, Sen. Josh Hawley (R-MO), was the only Republican to join Democrats Wednesday to move the Preventing Elected Leaders from Owning Securities and Investments — yes, the “PELOSI Act.” It has since been renamed the “HONEST Act.”

While originally a jab at ex-House Speaker Nancy Pelosi (D-CA), whose husband has faced scrutiny for well-timed trades, Pelosi backs the (renamed) bill, saying she supports “any serious effort to raise ethical standards.”

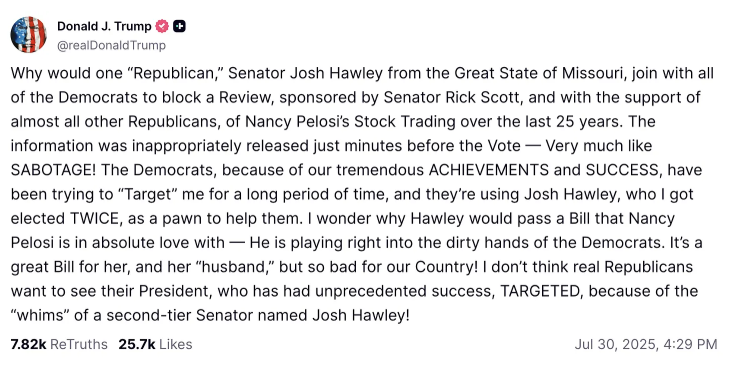

Hawley, who says he does not own any individual stocks, said he will move ahead with the legislation despite some major backlash from some in his own party, including President Donald Trump.

Switcheroo: Hawley said he spoke with President Trump on Thursday and cleared up some confusion — which he said was caused by other senators telling Trump the bill would force him to sell all of his assets and properties. Hawley said by the end of the call, the president’s stance was: "This is good.”

INSIDE THE BILL

If passed and signed into law — and that is a big if — the bill would prevent both members of Congress and their spouses from buying, selling, or owning individual stocks.

The bill would prevent all presidents and vice presidents from doing the same — but only starting during the next presidential term, thanks to a last-minute carve-out for Trump and Vice President JD Vance.

Republicans argued that the bill would unfairly punish and disincentivize wealthy Americans from becoming members of Congress. It’s also expensive to be a lawmaker, splitting time between their home district and DC. Members of the House and Senate make $174,000 per year — which has not changed since 2009.

HOW IS THIS LEGAL?

A number of members of Congress in both parties have made tens of millions in recent years, trading off information only they have access to, but it has been historically difficult to prove insider trading. Nearly a fifth of lawmakers on both sides of the aisle have bought stocks that are directly tied to their work on congressional committees, a 2022 New York Times investigation found.

Back in 2012, President Barack Obama signed the STOCK Act into law — with bipartisan support. It requires lawmakers to disclose their trades and bans trading on nonpublic information.

It has not done much to deter trading. That is likely because the penalty for violating it is $200.

More than 100 members of Congress (out of 541) have made around 10,000 stock trades per year since 2021 — and they’ve consistently beat the market. In 2024, Democrats’ average return was over 31%, and Republicans around 26%, according to estimates from Unusual Whales. The S&P 500 returned just over 23%.

2025 is on pace to be a record year for trades, according to the platform Capitol Trades.

WHAT’S NEXT

The future of the bill is uncertain, as all Republicans on the Senate committee except Hawley voted against the measure. The GOP controls both the House and Senate, but with slim majorities — so passage could be possible if a few more Republican defectors join.

Nearly 80% of Americans support banning members of Congress from trading individual stocks, according to a 2022 poll from Data for Progress.