Weak New U.S. Jobs Data Sparks Concerns Over Trump’s Economic Agenda

The U.S. labor market showed new signs of strain in the latest jobs report Friday, with hiring slowing far more than expected and data revisions revealing the first monthly job losses since the pandemic.

By the numbers: Employers added just 22,000 jobs in August, well short of economists' forecasts for 75,000, while the unemployment rate rose to 4.3% — the highest since 2021. June figures were also revised down, revealing a loss of 13,000 jobs, the first monthly jobs losses since December 2020. July’s numbers were revised slightly higher to 79,000.

What that means: A cooling jobs market that could indicate an economy that is slowing down and headed towards a recession.

While Trump’s White House economic adviser Kevin Hassett told CNBC the report was disappointing, he downplayed it on Fox News, noting the Bureau of Labor Statistics often revises August numbers upward due to poor initial survey response rates.

DRIVING THE DECLINE

Economists say President Trump’s tariffs and immigration restrictions are weighing on hiring, as companies face higher costs and fewer people filling the gaps.

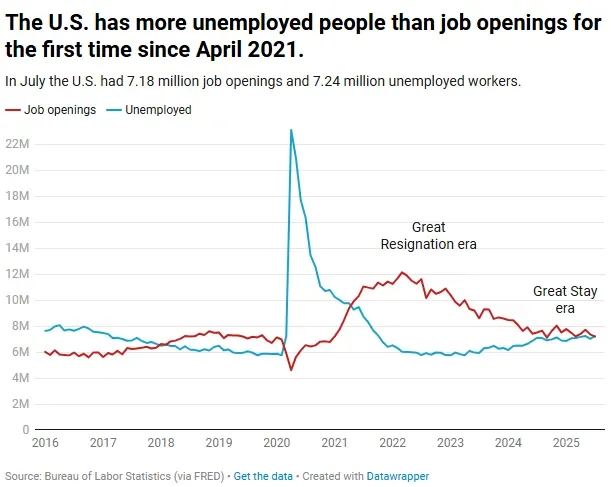

Meanwhile, the rate of job-switching has dropped, and job openings fell to a 10-month low, suggesting fewer opportunities for workers.

🚨 The number of unemployed people in the U.S. is now higher than the number of job openings available — making it a hard time to apply. Of those who are unemployed, more than a quarter have been jobless for six months or longer.

Hassett argued the underlying data is still strong, pointing out that job growth came from the private sector (government jobs fell by nearly 100,000 since the start of the year), gains were concentrated among native-born workers (not foreign-workers), and wages are growing.

However, annual growth in average hourly earnings was 3.7% in August, down from 3.9% the month before.

And data suggests that businesses are not hiring workers to fill the gaps created by Trump’s immigration crackdown. Bottom line: Businesses are trying to do more with less, amid economic uncertainty around tariffs.

Up next: The latest numbers are getting close attention from the Federal Reserve, where Chair Jerome Powell has signaled that interest rate cuts are likely to come after the group's mid-September meeting if labor market conditions continue to deteriorate.

SPEAKING TO THE SOURCE

We spoke with Austan Goolsbee, President of the Federal Reserve Bank of Chicago — one of just a dozen people who help set U.S. interest rates — along with our friends at Money Rehab, about the state of the economy under the current administration. He emphasized that “the Fed must be independent” and warned that political interference could lead to spikes in inflation, slower economic growth, and higher unemployment.

Goolsbee hinted that interest rates would move down — eventually. While he wouldn’t commit to a number, he said a “fair bit” below current levels feels right, if inflation keeps easing.

He described the recent economic outlook as “strong” before April 2, when new tariff policies introduced “dirt in the air” that muddied the data. If those policies ease or are clarified, he believes the Fed may continue on the path to cuts.

🎧 Check out our full conversation with Goolsbee — dubbed “the funniest man in Washington” — on Apple, Spotify, or wherever you get your podcasts.